On March 19, 2023 UBS took over Credit Suisse in coordination of the Swiss Government for a price of CHF 3 Billion (USD 3.3 Billion) or 76 cents per share. It was decided as well that the AT1 Bonds of Credit Suisse worth USD 17.6B would be written down. This was a big surprise and here is why.

1. Let’s explain firstly and very shortly some jargons that you need to know.

AT1 (additional Tier 1) securities are a form of “contingent-convertible” bonds created after the global financial crisis of 2008 to prevent the need for government-funded bail-outs of precarious banks.

Cocos, as these instruments are known, are a hybrid of bank equity (the money invested by shareholders, which absorbs any losses in the first instance) and debt (which must be repaid unless a bank runs out of equity).

In good times, they act like relatively high-yield bonds. When things go sour, and trigger points are reached—such as a bank’s capital falling below certain levels relative to assets—the bonds convert to equity, cutting the bank’s debt and absorbing losses.

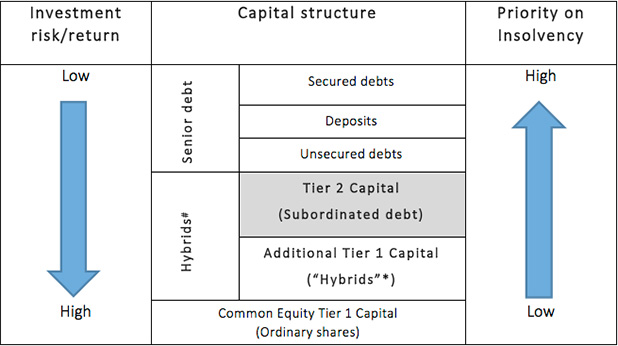

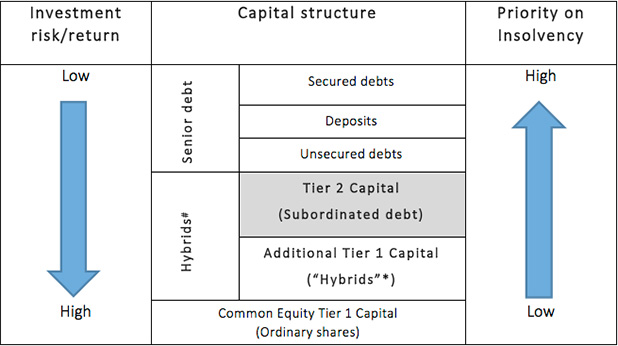

In the following corporate capital structure we see that holders of Tier 1 Capital Debt can claim their money back after the (secured and unsecured) bond holders BUT before equity holders in case of insolvency of the company.

2. Now the last jargon piece, we need to understand what is a CET1 ratio.

CET1 stands for “Common Equity Tier 1” capital. CET1 ratio compares a bank’s capital against its risk-weighted assets to determine its ability to withstand financial distress.

The core capital of a bank includes equity capital and disclosed reserves such as retained earnings. As long as the CET1 raio is above a certain trigger, the AT1 Bonds will not be converted to Equity or written down.

3. What was the CET1 ratio of Credit Suisse at the time of the merger?

AT1 bonds can be converted to equity or permanently or temporarily be written down in case the company’s CET1 ratio reaches a certain barrier defined in the Bond prospectus. Every AT1 Bond has specific terms & triggers.

The CET1 ratio of Credit Suisse was as of Q4 2022 14.1%, which is a pretty healthy level and well over the minium of 10% required by Swiss law. Most CS AT1 Bonds had a CET1 trigger of 7%. So why did the Swiss government write down the AT1 Bonds?

4. Arguments of the Swiss Regulator (FINMA)

Contractural basis: The AT1 instruments issued by CS contractually provide that they will be completely written down in a “Viability Event”, in particular if extraordinary government support is granted.

Federal Council’s Emergency Ordinance: As Credit Suisse was granted extraordinary liquidity assistance loans secured by a federal default guarantee on 19 March 2023, these contractual conditions were met for the AT1 instruments issued by the bank. Based on the contractual agreements and the Emergency Ordinance, FINMA instructed Credit Suisse to write down the AT1 bonds.

5. What are the arguments of AT1 Bondholders

The merger was not a “viability event” because a) there were no capital adequacy issues (CS’s CET1 end 2022 was 14.1%) and b) there were no public capital support measures taken.

The law prior to March 19 did not allow for a FINMA order to write-down the bonds outside of a restructuring proceeding. Therefore, on March 19, the Swiss government adopted law essentially opening the door for FINMA eventually ordering a write-down of AT1 capital.

Potential claims arising from the above:

A) Against CS: on March 15 CS disclosed that there were no issues. This could be seen as lack of disclosure and mis-selling, especially if CS already knew that the deal with UBS would be enforced.

B) Against the Swiss government: key question is if the trigger for a write-down was appropriate. If not, the FINMA decision would potentially qualify as expropriation.

C) Foreign investors could use so-called bilateral investment treaty claims Switzerland has in place with many countries due to a) expropriation and b) fair and equitable treatment of foreign investors. This must be assessed on a case-by-case basis.

Assuming there was a trigger and capital adequacy of Credit Suisse was below 7% at a given point, and based on the current share price of UBS (and CS), one would expect that these AT1 bonds could have been converted into Credit Suisse common stock.

The market value of the USD 17.6B nominal would be around USD 4.5B. That is roughly 25% of the face value of the bonds (bad but better than nothing).

6. Who was affected?

David Tepper, the billionaire founder of Appaloosa Management and Mark Dowding, CIO of RBC BlueBay are among the various holders of the USD 17.6 Billions of CS AT1 Bonds according to http://zerohedge.com