Every year, economists and financial analysts publish their outlook for the S&P 500, which is a stock market index that tracks the performance of 500 large companies listed on US stock exchanges. The economists’ outlook is typically based on a range of factors that are expected to influence the stock market’s performance over the coming year.

These factors may include macroeconomic indicators such as GDP growth, inflation, interest rates, and employment levels, as well as corporate earnings and revenue growth of companies in the S&P 500. Other factors that may be taken into account include geopolitical risks such as trade tensions, political uncertainty, and global economic conditions, as well as market trends and investor sentiment.

Based on these factors, economists may offer a range of outlooks on the S&P 500, ranging from bullish to bearish. A bullish outlook generally suggests that the economy is expected to perform well and that the stock market is likely to rise, while a bearish outlook suggests that the economy may struggle and that the stock market may decline.

It’s important to note that the economists’ outlook is just one perspective on the stock market’s performance, and it is not a guarantee of future results. Many unexpected events can occur that may influence market outcomes, and past performance is not always indicative of future results. Therefore, investors should consider a range of factors when making investment decisions, including their own risk tolerance, investment goals, and time horizon, and they should regularly review and adjust their investment strategies as needed.

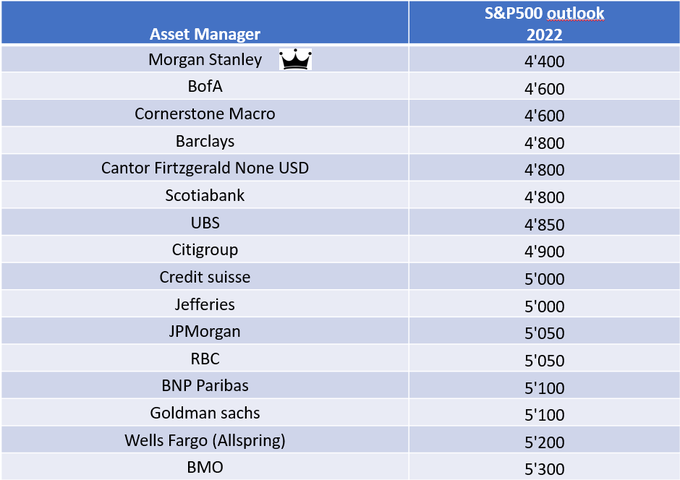

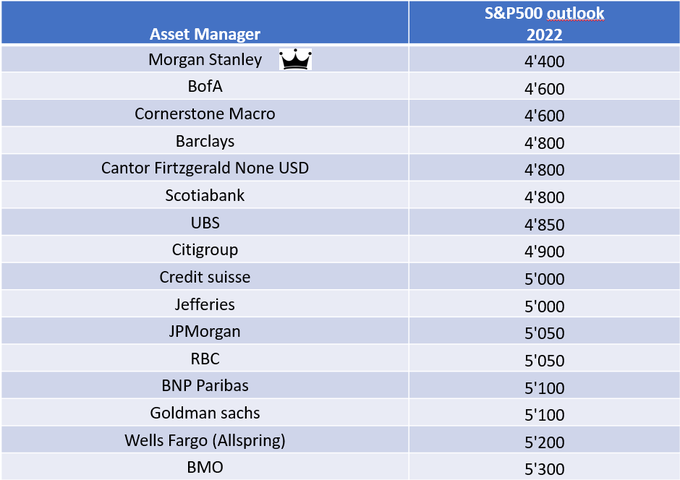

Who as right about 2022?

The S&P 500 is currently trading at 3,960.

The best S&P500 outlook for 2022 so far was given by

-> Morgan Stanley 4,400 (Chief Analyst: Mike Wilson)

-> BofA 4,600

-> Cornerstone 4,600

The worst S&P500 outlook 2022 so far was given by

-> BMO 5,300

-> Wells Fargo 5,200

-> Goldman Sachs 5,100

Conclusion: Eventhough his forecast was still far from the actual levels, Mike Wilson from Morgan Stanley did the best forecast.